Amazon Arbitrage 2026: Mastering the Data-Driven "Digital Treasure Hunt"

Amazon Arbitrage 2026: Mastering the Data-Driven "Digital Treasure Hunt"

In 2026, Amazon Arbitrage has evolved from a manual "hustle" into a sophisticated, AI-augmented trading strategy. With the global e-commerce market projected to exceed $6.88 trillion, the arbitrage model—buying undervalued products from one marketplace to flip on Amazon—remains one of the most accessible yet high-performance entry points for digital entrepreneurs. However, the "launch and hope" era is officially over; success in 2026 requires surgical data precision, agentic AI sourcing, and a globalized mindset.

The Arbitrage Landscape: Retail vs. Online in 2026

Arbitrage essentially exploits price discrepancies across the digital and physical retail world. While the core principle remains "buy low, sell high," the methods have diverged into two primary paths.

The Rise of Agentic AI Sourcing

By 2026, the most successful arbitrageurs are no longer manually browsing websites. They utilize Agentic AI systems like "Interests AI" and "Rufus" to monitor millions of data points simultaneously. These agents can reason through supply chain disruptions, anticipate demand spikes based on social trends (e.g., TikTok virality), and execute "Always Be Scanning" protocols across 1,000+ retail sites.

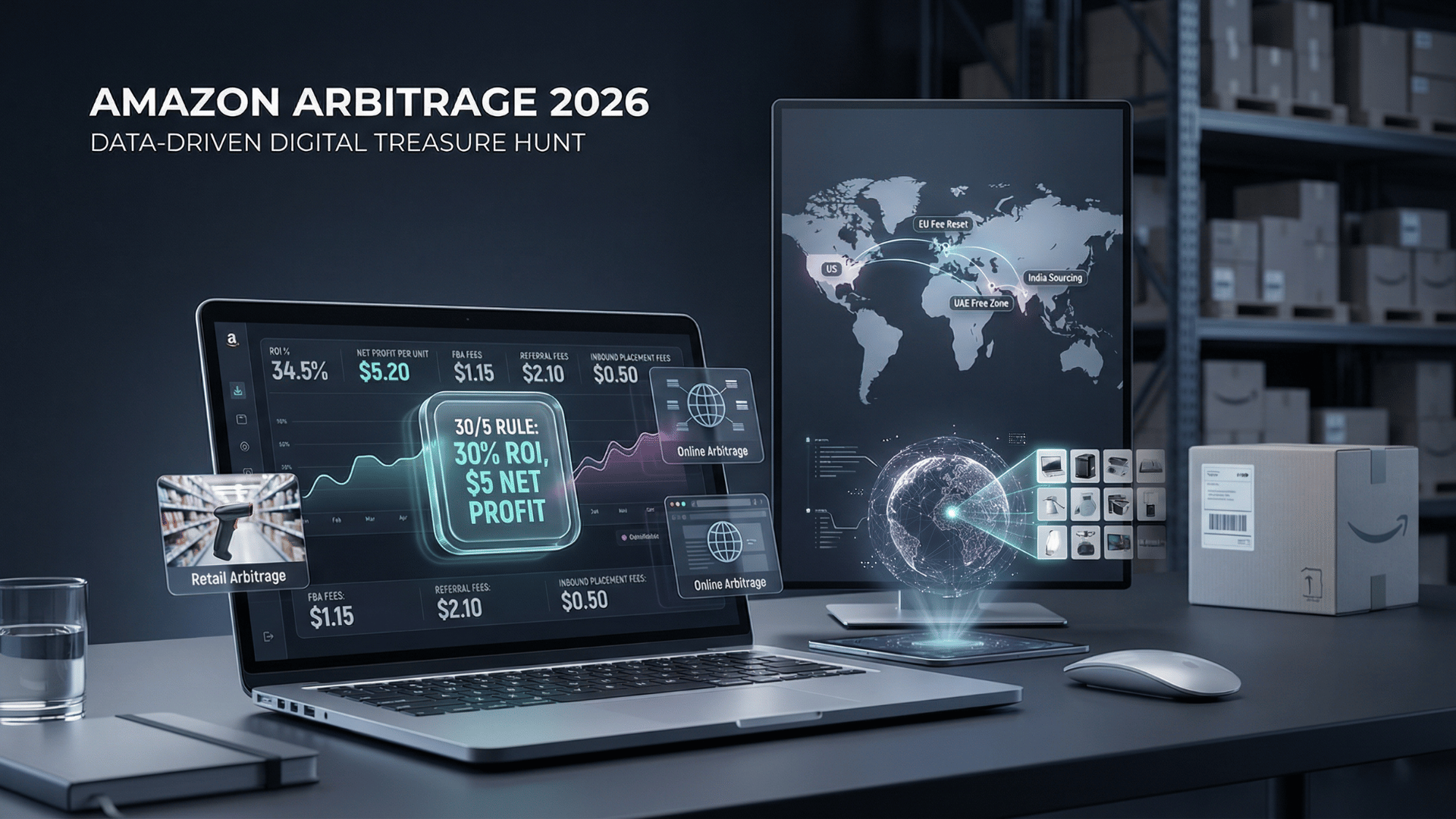

Financial Benchmarks: The "30/5 Rule" for 2026

With rising FBA fees—which saw an average increase of $0.08 per unit in early 2026—margin discipline is the difference between a thriving business and a failing one. Professional sellers now adhere to the 30/5 Rule:

- 30% Minimum ROI: Aim for a 30% Return on Investment to buffer against price wars.

- $5 Minimum Net Profit: Never list a product with less than a $5 net profit per unit to protect against Amazon's dynamic fee adjustments.

Calculating Your Real Margin

To find your true profit, you must use the updated 2026 ROI formula which accounts for inbound placement fees and low-inventory penalties:

ROI = \left( \frac{\text{Selling Price} - (\text{Sourcing Cost} + \text{FBA Fees} + \text{Referral Fees} + \text{Inbound/Storage Fees})}{\text{Sourcing Cost}} \right) \times 100$$

The 2026 Tech Stack: Tactical Arbitrage vs. Helium 10

In 2026, choosing the right tool determines your sourcing speed. While Helium 10 remains the king of Private Label SEO and keyword research, Tactical Arbitrage (TA) is the undisputed leader for arbitrage operators.

- Tactical Arbitrage: Offers AI-powered image matching and UPC alignment to scan thousands of categories simultaneously across 1,000+ sites.

- Helium 10: Best for "Reverse ASIN" lookups to see what competitors are selling and identifying "indexing gaps" where an arbitrage product can win organic rank.

- Nano Banana Pro: Used for creating "Story-Driven" listing images. Arbitrageurs use it to transform basic manufacturer photos into high-conversion infographics and 4K lifestyle shots without a studio.

Global Arbitrage: EU, UAE, and India Opportunities

Saturation in the US market has pushed smart sellers toward emerging and resetting marketplaces.

1. The European Union (EU) 2026 Fee Reset

Amazon has implemented one of its largest fee reductions in Europe, lowering FBA fulfillment fees by an average of €0.17 per unit. This makes "Cross-Border Arbitrage" between the UK and EU highly lucrative, especially in high-volume categories like Home Products and Pet Supplies, where referral fees were slashed from 15% to 5-8%.

2. The UAE and India Frontier

- UAE: Offers a "Free Zone" entry for arbitrageurs with 0% corporate tax and streamlined digital licensing (eTrader) for expats.

- India: New FDI draft rules allow Amazon to purchase directly from local sellers for exports, creating a massive sourcing pipeline for Western arbitrageurs looking for high-quality, low-cost "Made in India" goods.

Risk Management: IP Claims and Brand Gating

The biggest threat to an arbitrage business in 2026 isn't competition; it's Account Health. Amazon has intensified its "Transparency Program" and automated IP (Intellectual Property) scanning.

The "Counterfeit Response Kit" Strategy:

- Authorized Invoices: Always source from retailers that provide commercial-grade invoices. Traditional retail receipts often fail authenticity checks in 2026.

- Brand Gating Alerts: Use tools like "Seller Assistant App" to check if a brand is gated before you buy inventory. Retroactive gating is common; Amazon may suddenly restrict a brand you've sold for months.

- 72-Hour Response Rule: If hit with an IP claim, you must respond within 72 hours with a clear "Plan of Action" (Root Cause, Corrective Action, and Preventive Measures).

Conclusion: Synthesis of the 2026 Arbitrage Strategy

Success in Amazon Arbitrage for 2026 is no longer about finding a "lucky" clearance item. It is about building a scalable system that combines Agentic AI sourcing, Global Marketplace diversification, and Extreme Margin Discipline.

By leveraging the fee reductions in the EU, the emerging infrastructure in the UAE, and the visual power of models like Nano Banana Pro to differentiate listings, arbitrageurs can achieve 20-30% consistent profit margins. In the era where "AI defines retail," the most successful arbitrageurs are those who treat their Amazon store not just as a shop, but as a data-driven trading desk.